Every newbie in the crypto market must be aware of . That is, how to open a short position and get returns. The most popular strategies are considered BTD (Buy the Dip) and HODL (buy and hold), but shorting crypto is undeservedly neglected in the trader community. This article will cover the main principles of shorting and getting profits in a bear market. Shorting is a more challenging process than opening long positions, in which you just have to purchase coins and wait for prices to rise in order to sell profitably. Let’s take a closer look at the basic principles of shorting crypto.

Shorting cryptocurrency: What does it mean?

A short is a position that an investor opens for getting income from falling prices in the market, and the trading strategy is known as a “short”. Market participants who short crypto are called short-term players or “bears”.

Short-term traders borrow an asset that they believe will decrease in price in the future and sell it at the maximum current value. When the forecast comes true and prices on the market go down, the trader will be able to buy assets back at a lower cost, pay his debt, and fix the profit. In other words, short is a leveraged and fast trade.

Short vs Long

The cost of digital coins can go up and down. As a rule, this is facilitated by economic crises, political unrest, or negative/positive news and events. These features of the market have formed two models of behavior among investors, which are implemented through different types of transactions:

Long position — a trader purchases digital coins during declining in prices in the hope of further raising price;

Short position — a trader acts in accordance with a reverse strategy and waits for the cost of coins to fall in order to rebuy them cheaper.

All crypto market participants strive to make a profit. Both short and long positions can provide profit from trades, but both of these concepts are fundamentally different from each other.

Traders using long positions can only make money in a growing market, and enterprising investors have learned to benefit from lower prices by opening short positions.

Another key difference is that long-term traders always open orders with their own money. That is, for successful execution of trades, the investor first should acquire a certain cryptocurrency and hold it in his portfolio until it changes in price. When shorting crypto, a trader can borrow a coin from the crypto exchange, get returns, and then repay the loan.

There are no particular differences in opening short and long positions. The choice in favor of one or another trading method depends only on personal preferences.

How to short cryptocurrencies?

The cryptocurrency market has high volatility that sets it apart from all others.

A prolonged period of growth can quickly turn into a sharp decline amid any minor unrest. If you know the basic rules, then such moments will become an opportunity to make money. At the same time, it is crucial to understand that when “playing short”, the risks of a market participant are much higher, since if the price falls by half, you can easily earn money, but if the price is rising, the trader loses his investment in the amount of 100%.

Opening short positions with leverage is a rather complicated and risky type of investment. This is especially true for altcoins with high volatility and low liquidity. To open short positions, you should be familiar with the basics of technical and fundamental analysis, know the specifics of the market and the psychology of its participants. In practice, not every trader who knows how to make money on opening long positions will be able to profit from the falling market.

First of all, in order to start shorting crypto, a trader needs to select cryptocurrencies, the value of which should decrease in the future. Next, you need to determine the moment of entering the market, take a loan and place an order. The success of the operation and its profitability depend on the correctness of the decisions made.

Those who want to short crypto with the hope of a decrease in value must necessarily take into account several points:

- Market growth is always gradual, but a bearish trend is always implemented quickly. To get the most out of a short position, a trader must learn to choose the right entry points.

- Shorting crypto allows you to earn a lot and quickly, but wrong actions can not only fail to bring results but also lead to a loss.

- The profit largely depends on the size of the initial deposit. The larger the initial size of the deposit and the leverage offered by the exchange, the more profit you can take.

The algorithm of a trader’s actions to open a short position is identical for almost all trading platforms:

- First of all, you need to choose a cryptocurrency exchange, study its fees for depositing and withdrawing funds, the rules for providing leverage and trading. It should be noted that not all exchanges allow you to trade with leverage.

- Secondly, you need to register on the exchange and deposit money into the exchange account. Sometimes, in order to short crypto, a trader needs to verify the account.

- Thirdly, it is necessary to analyze the market and determine the downward trends.

- Then you need to go to the margin trading section and select the cryptocurrency that you are going to borrow and its volume.

- After the loan is issued and a sell order is placed, you need to wait until it closes.

- Next, you will need to wait until the market meets expectations and buy the asset back at a reduced cost.

- The debt is returned to the exchange, and the difference from the transactions remains on the exchange account on the personal balance.

As a rule, leverage is provided by a trading platform at a small percentage, but it must be taken into account when you are planning to enter the trades since this can mitigate profits or lead to a loss.

How to start shorting crypto via the Cryptorobotics trading platform?

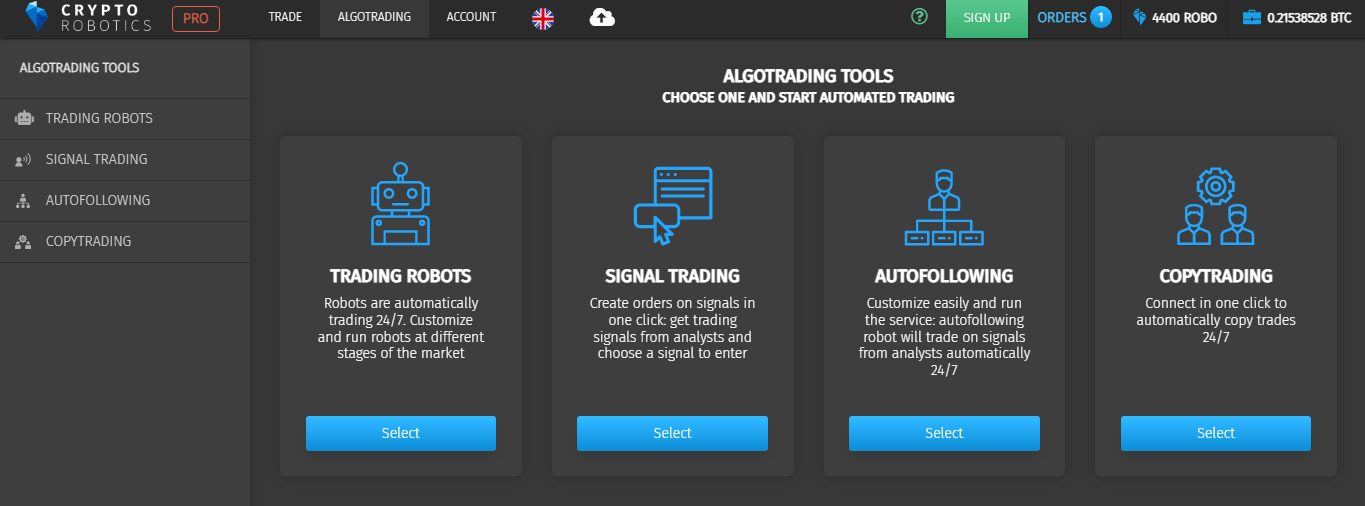

One of the most convenient ways to open short positions is to use the Cryptorobotics trading platform. This trading platform provides different tools for entering the trades during downtrends. Thus, traders are able to easily open short positions and customize various functions for manual and algorithmic trading on this platform.

Here are several examples of trading tools provided on the Cryptorobotics trading platform:

- Crypto trading bots

- Autofollowing

- Copytrading

- Signal trading

In order to start shorting crypto on this platform, you should complete the following steps:

- Go to the terminal.

- Register.

- Create an account on one of the exchanges integrated into the terminal.

It is worth noting that you can open short positions via the terminal on the following exchanges:

- Binance Futures

- Bybit Inverse

- Bind an exchange account to the Cryptorobotics terminal.

- Select manual or algorithmic trading.

- Start the trading process.

Besides, this platform allows managing the risks by setting up these features: Stop Loss, Take Profit, and Trailing. These tools can significantly minimize losses and increase the traders’ income.

All these orders can be placed using the chart. When setting parameters for buy, the values of Stop Loss, and Take Profit will immediately appear on the chart.

Each value can be edited not only in the block on the left but also by moving the widget up and down.

After you click the buy button, the order will go directly to the order book.

When the buy order is filled, you will receive a notification.

If you click on the cross, the OCO, or smart order will be canceled.

When you click on the central part of the chart or move the widget, a block with OCO’s parameters will be opened. Here you can view all settings of the order, if you want to change them and close, it is necessary to click the “Sell” button.

If you have changed the order parameters, do not forget to click on the blue button “Save changes”.

Conclusion

Opening short positions promise quite high profits, even against the background of a general market decline. If you trade on the exchange but do not use a short-selling strategy; then, this is anything but full-fledged trading. Market participants must make money under any circumstances and trends, and for this, they need to be able to open both short and long positions.