Due to unforeseen circumstances, you can occasionally need to access the money immediately, whether for an urgent situation, a loan repayment, or a past-due credit card payment. Most of the time, the loan application and approval process is so laborious that it can exhaust you. Additionally, if you have an emergency, you cannot wait days for your loan to be authorized.

However, there are numerous websites that offer loans on some basic terms and conditions. But finding one reliable website is quite an arduous task in this period. You can choose the best lender for your borrowing needs with Personal Loan Pro, which is an online marketplace. You can compare lenders using this free service’s straightforward online application.

Everyone deserves a wonderful loan, according to Personal Loan Pro, which is why it was formed. Their goal is to make it simple for you to obtain a decent loan so you can move on with your life. To assist you in finding a fantastic deal, they connect you with a vast network of lenders. They will swiftly and conveniently assist you in locating the best loan for your needs.

What is a Personal Loan?

Personal loans have grown to be a common form of borrowing money. A personal loan can be used for anything you like, including debt consolidation, house improvements, and wedding expenses. Additionally, the finest personal loans frequently have interest rates lower than those charged by credit cards or other high-interest consumer debt, including payday loans.

The loan-matching business PersonalLoanPro has a significant lender network. Although it is a legitimate marketplace for private lending, loans are not given there directly. Make sure you comprehend the terms of any loans you take out; pay attention to things like interest rates, rate flexibility, prepayment fees, and other upfront prices and charges.

How Does Personal Loan Pro Work?

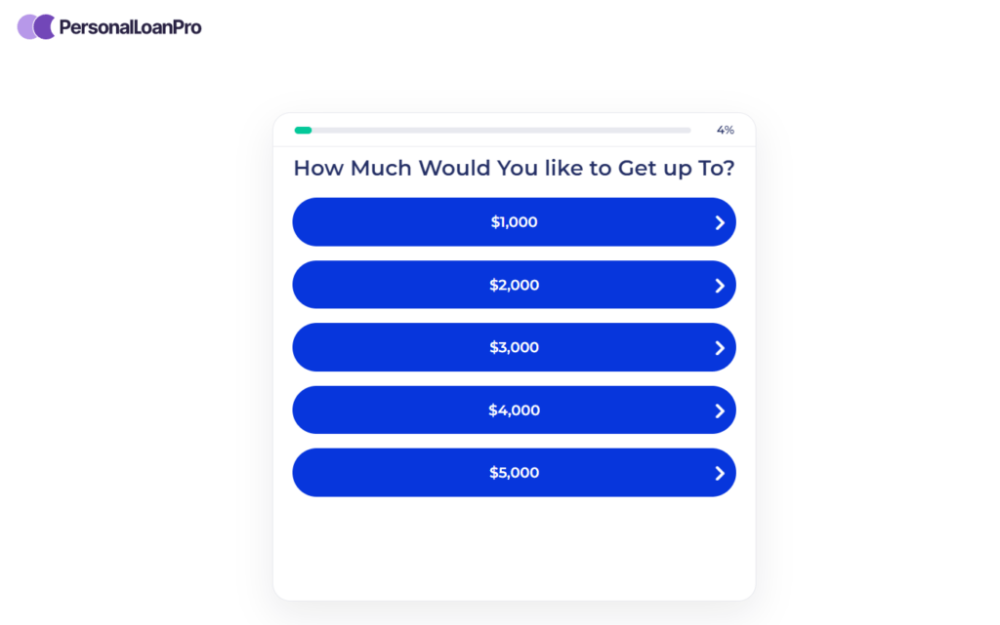

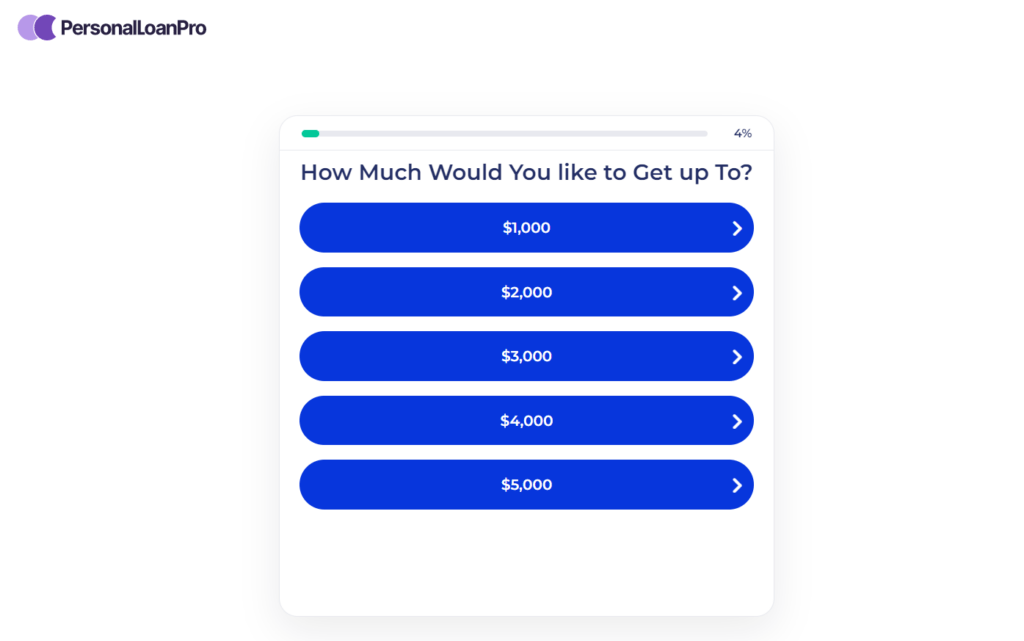

You are matched with loans through PersonalLoanPro based on your needs. You must submit a quick and free online application, which won’t have an impact on your credit score unless you choose one of the borrowing alternatives in the end.

Your loan request is sent to the company’s network of lenders, who subsequently respond with any offers you qualify for. Its borrowing conditions depend on variables, including your credit score, the loan amount, and the timetable for payback.

With its simple user interface, Personal Loan Pro has made the process straightforward. Your inquiry will be sent to their group of lenders after you complete only one form on their website. Your application will be reviewed by the lenders, who will then decide whether to provide you with a loan in the range of $100 to $5,000.

You are free to respond to the lenders as you like. The website of the lender will be your next stop, where you can check the terms of the loan, the applicable rates, and the applicable conditions. In a day, if you accept the terms, the lender swiftly wires the funds to your bank account. The procedure has been simplified by Personal Loan Pro to make it simple. Visit the website right now to apply for personal loans right now.

Why Choose Personal Loan Pro?

If you’re looking for funding, Personal Loan Pro is a website that compares loans and enables you to do it swiftly. You won’t pay anything to use the website because it is funded by lenders rather than borrowers.

It is important for borrowers to be aware that Personal Loan Pro does not act as a lender and does not determine who is eligible for loans or what their interest rates will be. You have the opportunity to compare quotations from several loan providers thanks to Personal Loan Pro without having to worry about your credit or deal with a lot of difficulties.

You can match with loan providers who the website’s algorithm believes would be a suitable fit by visiting the website, choosing the purpose of your loan, and answering a few short questions. When you enter your information, Personal Loan Pro connects you with various lenders from whom you might be able to borrow money. Instead of visiting the websites of numerous providers individually to evaluate rates and terms, you may acquire estimates and terms from many lenders all in one location.

You might obtain a $1,000 loan or a $50,000 loan with Personal Loan Pro. You might only be able to borrow part of the amount you need because lenders frequently have higher minimum or lower maximum loan restrictions. Compared to a standard service, Personal Loan Pro offers you a lot more options.

How Can You Qualify for a Personal Loan via Personal Loan Pro?

The majority of vendors search for candidates that meet the following criteria, while different lenders have varied requirements. It must be older than 18 years old. The person must be a citizen of the US or a lawful permanent resident. You have to be working at your current job for at least 90 days and have a reliable source of income. It should make at least $1,000 each month once taxes are taken into account. The home phone number, work phone number, and email address of the person should be legitimate.

Is Personal Loan Pro Secure?

It’s a smart idea to use Personal Loan Pro if you’re looking for a loan and want to be matched with a number of different lenders to compare interest rates and repayment terms. It’s likely that you’ll need decent to excellent credit to be accepted for a loan.

Personal Loan Pro is not a good option if you prefer to receive quotes only from banks and credit unions that you have personally investigated and chosen because you have no control over which lending partners in the site’s network will receive your loan application.

Conclusion

Because you can complete a single application and receive loan offers from a number of lenders, websites like Personal Loan Pro have made it much simpler to swiftly shop and compare the finest personal loans. You can use this to attain your particular financial objectives.