Are you looking for ways to plan your path out of financial abuse? Between 21 and 60 percent of victims of intimate partner violence lose their jobs due to reasons stemming from the abuse. Financial control is a widespread element in many abusive relationships.

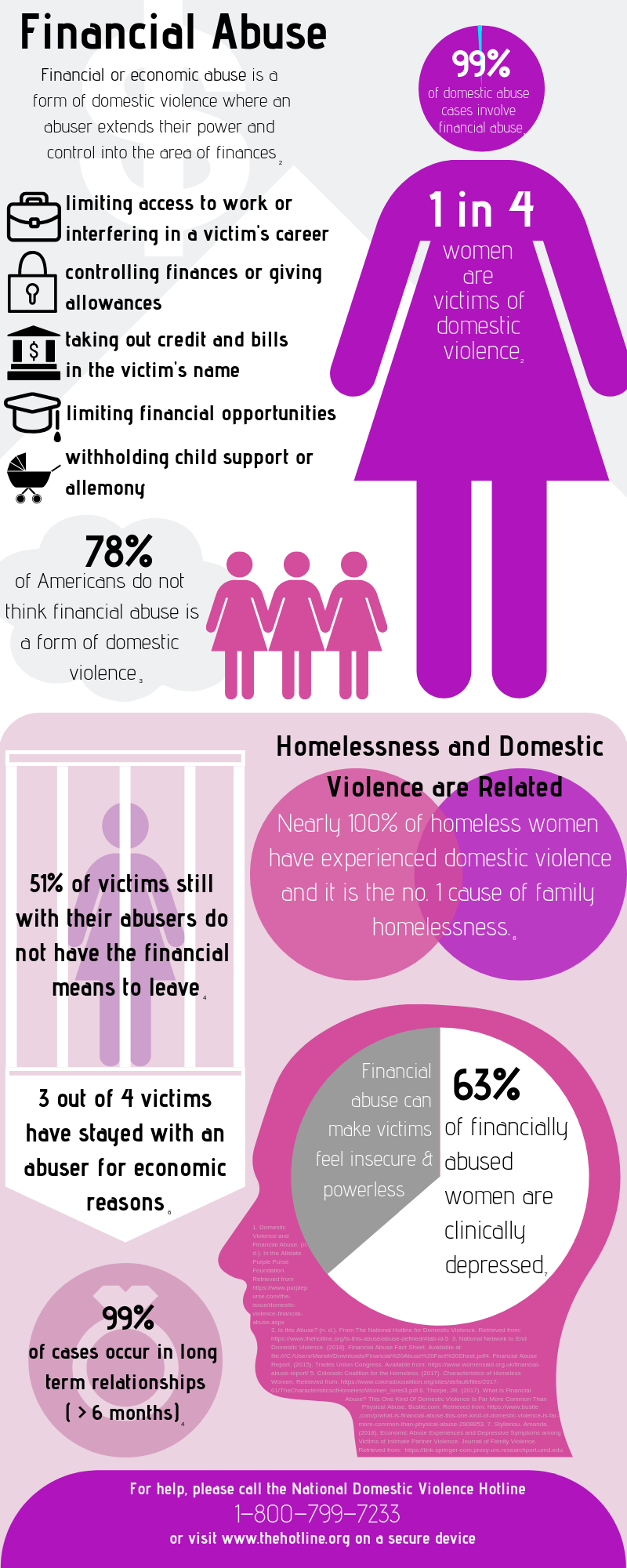

Up to 99% of domestic violence survivors have experienced financial abuse in some form. The monetary struggles and need for getting created through this form of abuse are common reasons why victims return to or stay with an abusive partner. If you are willing to break this vicious cycle of violence, you need to follow these financial planning tips.

Statistics on Domestic Violence

According to the , nearly 20 people per minute are physically abused by an intimate partner in the USA. During one year, this equates to more than 10 million women and men, while women struggle more. One in four women and one in seven men have been victims of severe physical violence by an intimate partner in their lifetime.

There is a huge economic impact on the victims of partner violence as they lose a total of 8.0 million days of paid work earn year. More than that, the cost of intimate partner violence exceeds $8.3 billion per year. Hence, personal financial planning tips can help women and men who were exposed to partner violence leave their abusive partners and become financially independent.

What Is Financial Abuse?

Domestic abuse is a pattern of behavior utilized by one partner to gain control and power over another partner in an intimate relationship. This is how the National Domestic Violence Hotline describes domestic violence. Such behavior includes both financial and economic control.

Financial abuse is a tactic to control monetary resources and decisions. The abuser usually has the power over financial decisions and opportunities and controls all the money leaving the other partner in the dark.

Unemployment and monetary disruptions can contribute to domestic abuse, while economic violence tactics can leave victims unprepared to safely leave their abusive partners. “Domestic violence is usually about control and power, while financial abuse holds so much control in our lives,” mentioned Ruth Glenn, president, and CEO of the National Coalition Against Domestic Violence.

Learning more about financial and domestic abuse may help people understand their situation and recognize the signs of violence while also getting useful advice on personal financial planning to start a new life.

Common tactics of financial violence:

- Controlling and monitoring the way money is spent

- Not letting another partner attend school or work

- Having access to bank accounts, shared funds, and credit cards

- Hiding debts and assets, financial infidelity

- Coerced debt

- Leaving another partner off of a rental agreement or mortgage

- Controlling, destroying, or stealing assets, income, possessions, or property

What Is Financial Planning and Why Is It Important?

Nobody expects the worst to happen but you need to be prepared for everything when you decide to go into a relationship. Financial planning is a set of specific strategies to maintain your monetary stability and independence.

Often people especially women don’t understand that what they are experiencing is called domestic violence. In order not to be blindsided, you should realize the danger you might face and follow certain steps in financial planning to help you become independent and prepared to leave.

Taking the necessary steps to become financially secure and independent is a savvy decision to protect your life as well as personal finances:

- Ensure you have a stable source of income to support your needs

- Stay informed about any shared monetary decisions

- Check your credit report on a regular basis

- Secure your personal data as well as your Social Security number and bank account logins

- Watch for any signs of financial abuse

Create a Safety Plan to Leave

Once you understand you are ready to leave an abusive partner, here are the steps you should take to prepare yourself in terms of personal finances:

1. Assess Your Current Position

The first step is to assess your present resources such as your cash, monthly income, and any investments or savings you have. Check the laws concerning any shared assets so that you know your rights. You may also add any other assistance and support offered by your relatives and friends.

Enumerate all the liabilities and expenses you have. It may include a mortgage, utility bills, and any other debt. Creating a budget can help you see the whole picture of what you will need to cover so that you can leave safely.

2. Create Independent Accounts

The financial planning process includes setting up your own accounts that your partner can’t access. It’s crucial for you to have your own funds set aside for an emergency. Having an independent emergency fund or a savings account will protect your safety and allow you to leave without issues.

3. Find a Side Gig

The next step is to find other sources of regular or irregular income. Finding a side gig or a part-time position can boost your income and protect your financial stability. You may also sell your old clothes or stuff to generate more cash. A side hustle such as babysitting, selling handmade items, dog sitting, or Uber driving may help you generate additional income. You may also find positions at Upwork, Fiverr, and other websites.

4. Improve Your Credit

You have the right to get a free credit report annually. Take advantage of this opportunity to see what your current credit rating is and improve it if necessary. A great tip is to put a fraud alert freeze on your credit reporting bureaus so that another partner can’t add more debt in your name. Paying down your credit card balances or repaying personal loans can also be beneficial to maintaining a decent credit score.

In Conclusion

If you feel you are ready to leave an abusive partner, follow our tips to protect your financial health and support you in your important decision. It won’t be easy to start a new life but it’s definitely worth becoming financially independent.